Dozens of workers die each year, and thousands more become sick while working in extreme heat or humidity, according to the Occupational Safety and Health Administration .

If your employees must work in hot environments, it’s important to know the risks and symptoms of heat-related illnesses, and how you can prevent them. Many factors have an impact on workplace risk for heat stress, ranging from the environment to physical condition of the employees. Workers at highest risk tend to be those who are over 65 years old, are overweight, have heart disease, have high blood pressure or take medications that may be affected by extreme heat.

Environmental factors

Environmental factors to consider in evaluating employees’ risk of working in hot conditions include:

- Temperature, clothing and exertion requirements.

- Humidity – high humidity impacts the effectiveness of perspiration.

- Wind – it can assist the body in cooling, but in high temperatures with high humidity it may actually increase heating of the body.

Know the types of heat stress

There are a number of different types of heat-related illnesses, which range in severity. They include:

- Heat cramps

Painful muscle spasms most likely in the arms, legs and abdominal area. Heat cramps are caused by sweating during strenuous activity and failing to replace the fluids and salt lost from sweating. - Heat exhaustion

Symptoms include profuse sweating, headaches, extreme weakness or fatigue, dizziness, fast pulse, rapid breathing and nausea or vomiting. - Heat or sun stroke

Symptoms include a very high body temperature (104 degrees F or higher); mental confusion, delirium or hallucinations; rapid breathing and pulse; hot, dry, red or mottled skin; convulsions; and loss of consciousness. Seek medical help immediately and keep the person cool with fans, ice and water until help arrives.

Prevent heat-related illness among your employees

OSHA recommends that employers with workers exposed to high temperatures:

- Monitor conditions regularly and follow consistent work practices.

- Train your employees about signs and symptoms of heat exhaustion, as well as the importance of hydration – See our 5-Minute Solution on heat stress which is also available in Spanish.

- Provide breaks as needed by the conditions.

- Consider completing outdoor tasks either early in the morning or in the evening whenever possible.

Educate employees on how to prevent heat-related illness

Employees have a role to play in protecting themselves from heat-related illness. Educate your employees on prevention by telling them to:

- Adjust themselves to the heat through short exposure periods followed by longer exposure until their body is acclimated to the heat. It may take 14 days or longer.

- Drink lots of liquid to replenish the fluid that their body is losing through sweating. Drink water to stay hydrated (about 1 cup every 15 minutes), and electrolyte drinks (sports drinks) to replace salt. A 3:1 ratio of sports drinks to water is commonly recommended. Don’t wait to drink until you’re thirsty, and avoid alcohol and caffeinated beverages.

- Do not ignore possible symptoms of heat stress. If their muscles cramp or if they feel very hot, dizzy or nauseous, then they should stop, hydrate, rest and cool off in the shade or air-conditioned area.

- Wear light-colored and loose-fitting clothes. Cotton breathes better than synthetic fabrics.

- Schedule work activities during the coolest parts of the day.

- Take the time to rest and cool down before they feel symptoms of heat stress.

- Report symptoms of heat-related illness in themselves or coworkers to their supervisor immediately.

You or your supervisors can use SFM’s 5-minute solutions training talk on heat stress as a guide to talk with employees.

Use heat safety app to identify dangerous conditions

OSHA and the National Institute for Safety and Health have created a free heat safety mobile app to make employers and workers aware of whether the heat index in their area creates a risk for heat-related illness.

The app also provides recommendations for preventing heat stress based on the risk level.

Learn more about preventing heat-related illness among employees

The Centers for Disease Control and Prevention and the Occupational Safety and Health Administration offer a number of resources that can help you protect your employees from heat stress, including:

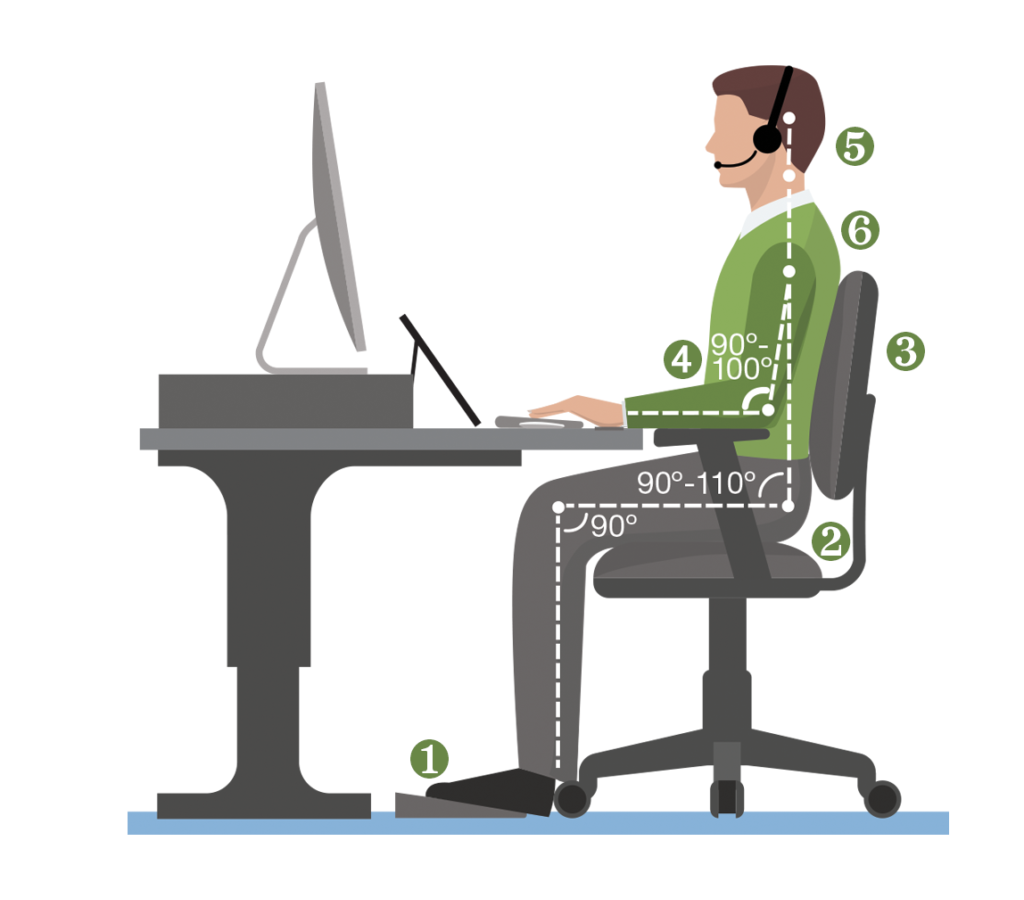

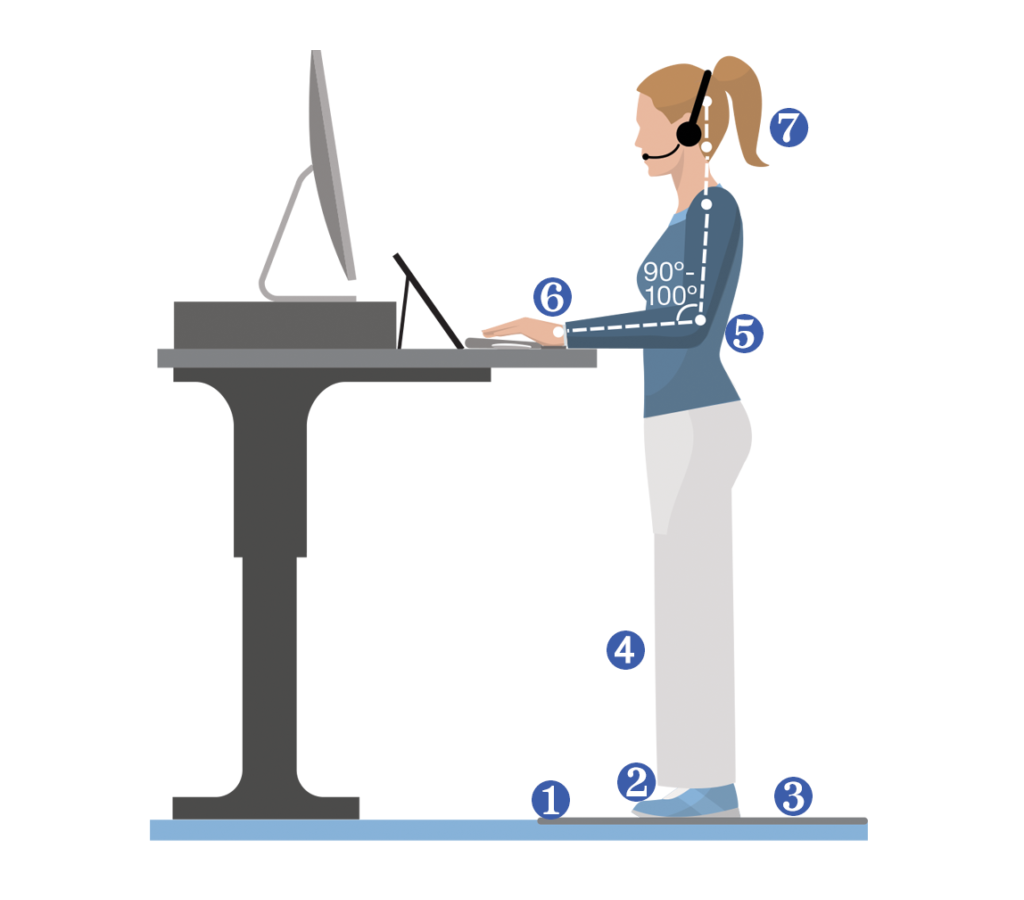

Keep your feet resting comfortably on the floor or on a footrest.

Keep your feet resting comfortably on the floor or on a footrest. Feet should be resting comfortably on an even surface.

Feet should be resting comfortably on an even surface.