They came. They saw. They learned a lot about workers’ compensation.

They came. They saw. They learned a lot about workers’ compensation.

With fall underway, SFM is taking a look back at the experience of its summer interns.

During the summer of 2024, SFM had four interns aboard:

- Lily Johnson, junior at Iowa State

- Rishabh Sharma, senior at St. John’s University in Minnesota

- Fathia Warsame, senior at the University of Minnesota

- Darius Watt, senior at Hamline University in Minnesota

This year’s goal was to provide broad exposure to workers’ compensation insurance in addition to the corporate side of the business. Instead of interns being assigned to specific teams, they rotated within four main focus areas throughout the summer, including claims, underwriting, analytics and communications/marketing.

“We are thrilled to continue introducing young people to the insurance industry and promoting SFM as an employer of choice through our internship program,” said Senior Vice President and Chief HR Officer Jody Rogers. “It’s our plan to offer summer internships for the foreseeable future.”

During their time with SFM, the group was introduced to the world of workers’ compensation insurance and how SFM handles claims, underwriting, communications, etc. They also created safety videos based on what they learned — focusing on the common workplace injuries incurred among young people. Johnson’s mentor was Sadie Zorn, Marketing Underwriter at SFM.

“It was such a joy and honor to be a mentor to Lily. She brought such fun energy, enthusiasm, and curiosity to the internship. As the summer went on, and she learned more about SFM and the insurance industry, which opened her eyes to the endless opportunities that our industry offers,” Zorn said. “A reoccurring comment from Lily was how welcoming SFM was, how friendly our staff are and how she could tell SFM was a great place to work. It was cool to see Lily catch on to and immerse herself into SFM culture throughout the internship!”

As a group, the interns talked about their experiences at SFM.

Underwriting

During the first week of June, SFM kicked off our intern rotations with the Underwriting team. This was beneficial because it transformed our brains into an insurance mindset. Underwriting Technical Specialist Jen Wolf was one of the first people to take the time to teach us workers’ compensation history, which set the foundation to be able to comprehend the syntax and acronyms used at SFM. As we increased our knowledge and understanding of underwriting, we were tasked with a handful of endorsement requests and eventually processed them.

Claims

We were able to apply our newborn underwriting knowledge and reach another level of understanding of workers’ comp. As a result of our claims experience, we are now able to apply the five W’s of who, what, where, when and why, and how they all have a crucial impact on claim files.

Analytics

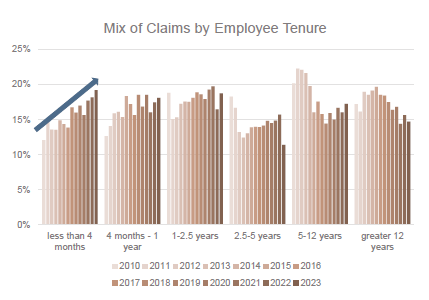

We were handed a large dataset containing 27,000 claims with over 50 variables and our general tasks were to answer questions using trends we identified. We learned a lot of cool tips and tricks from Analytics team members and how to turn around projects in a short amount of time.

Communications/marketing

We learned many methods that are utilized to stay up to date on resource literature, websites and blogs. We also learned how SFM uses style guides to communicate effectively and professionally.

We also used our time in Communications to finish our group project, which was to create short safety videos to help younger workers avoid common injuries. We made our final presentation to SFM management, internship leaders and mentors during the last week of our internship.