Account types and territory

Our underwriting philosophy

You may be wondering: “What types of accounts does SFM want to write?”

Above all else, SFM is interested in employers who care about safety and want a long-term partnership with their workers’ compensation carrier.

We’re looking for employers where management believes in taking care of their employees.

~ Steve Sandilla, SFM Senior Vice President & Chief Business Officer

A broad range of coverage

More than half of our policies are $5,000 in premium or less. We continue to grow in small business by offering a convenient online application process, fast quoting and competitive pricing. We can also meet the needs of the largest employers through specialized loss prevention and claims management services. We can cover any operation — from a family employing a single nanny, to a chain of stores employing thousands.

Our newest rate set gives underwriters more flexibility

The SFM Safe rate set gives many policyholders previously covered by the state assigned risk plan a lower-cost option, and allows us to write additional classes of business. SFM Safe rates are now available in Minnesota, Iowa, Nebraska and South Dakota.

We offer specialized loss prevention services for schools

With many large school districts as policyholders, schools are a focus area for our loss prevention team. We offer specialized safety resources and expertise for loss sources specific to schools such as falls among custodial workers, musculoskeletal injuries among kitchen workers and falls among bus drivers.

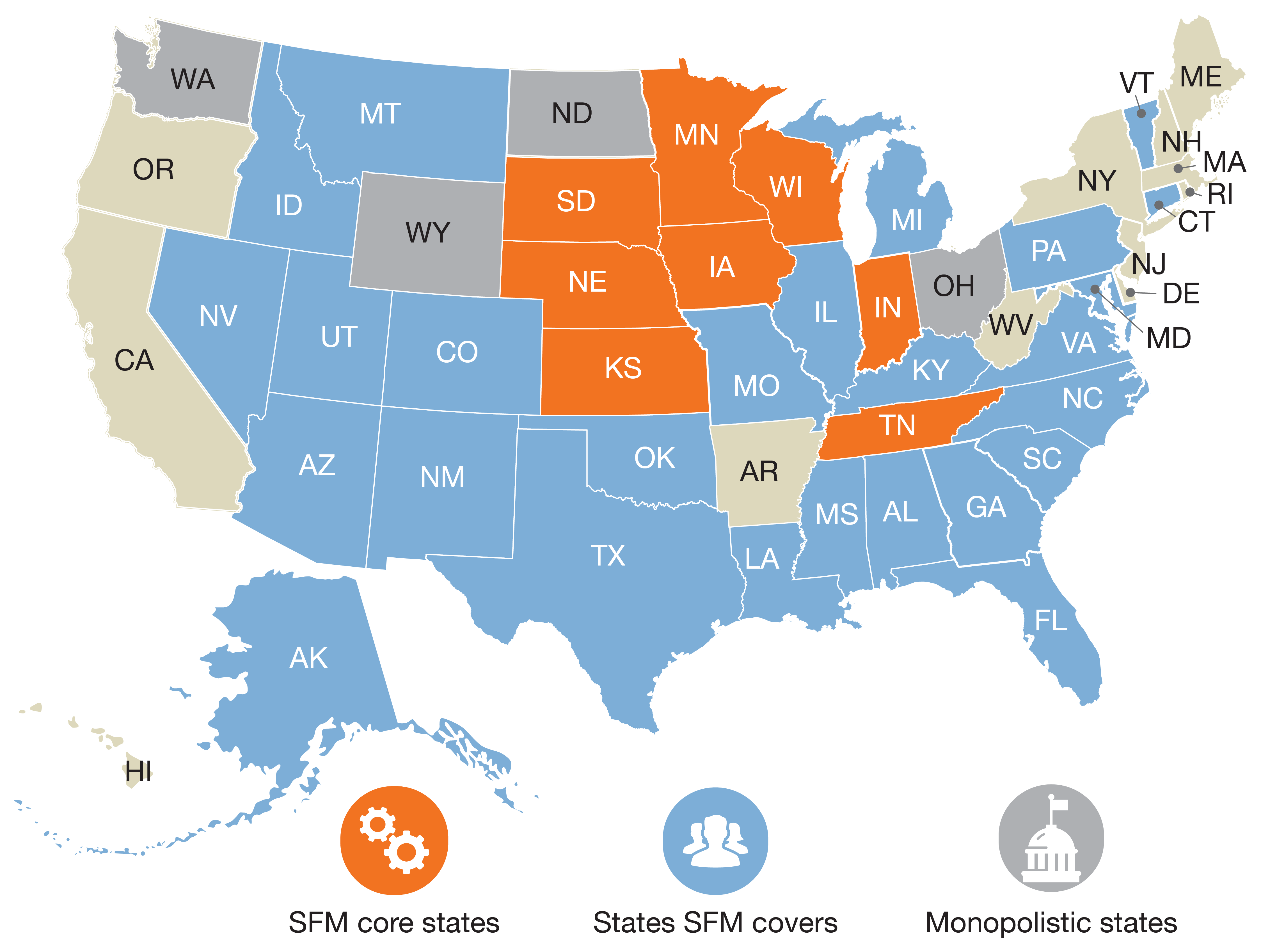

Coverage throughout the Midwest and beyond

As the leading workers’ compensation insurer in the Midwest, we serve employers based in Minnesota, Indiana, Iowa, Kansas, Nebraska, South Dakota, Tennessee and Wisconsin.

We also provide coverage to employers with out-of-state operations in Alabama, Alaska, Arizona, Colorado, Connecticut, Florida, Georgia, Idaho, Illinois, Kentucky, Louisiana, Maryland, Michigan, Mississippi, Missouri, Montana, Nevada, New Mexico, North Carolina, Oklahoma, Pennsylvania, South Carolina, Texas, Utah, Vermont and Virginia.

Driving better outcomes for employers

When your clients choose SFM, you can rest easy knowing our experienced, locally-based claims representatives will manage the claim well and ensure the best possible outcome for the injured worker and the employer.

Even smaller employers who never expect to have claims benefit by knowing if the unexpected occurs, they’ll have an experienced claims representative to help them through the process.

For larger employers, the long-term value of high-quality, attentive claims management and loss prevention services is clear. Most larger SFM policyholders see their experience modification factors decrease over time.