While pricing and coverage difficulties persist in other property and casualty segments, especially property insurance, agents shouldn’t let workers’ compensation insurance fall by the wayside.

Other lines of insurance may garner more headlines, as well as your attention, but there are several benefits to working with a work comp expert, especially considering some of the industry developments in recent years. Some concerning trends carriers are watching include:

- Higher claims severity

- Aging workforce

- Rise in workplace violence claims

- Mental health issues

- Increase in litigated claims

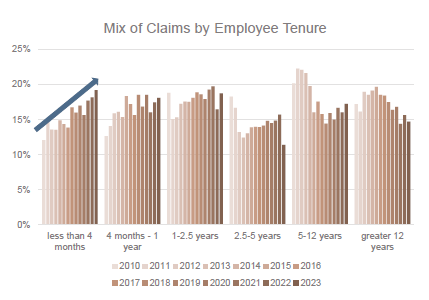

- High rates of injury frequency among newer employees

- Medical inflation

At the same time, multistate employers may face difficulties navigating the differences in claims rules and regulations, which can vary based on the jurisdiction.

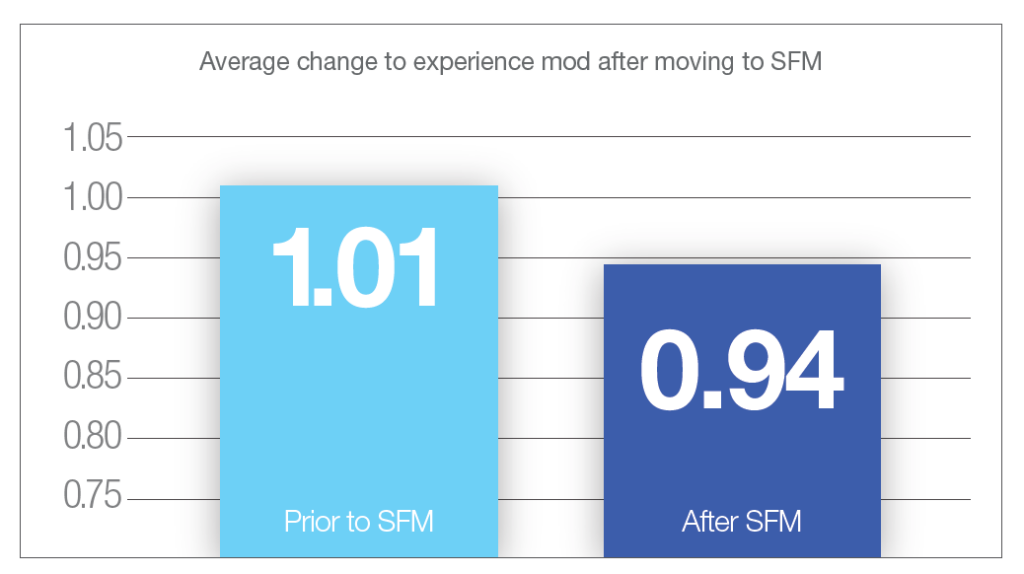

“Workers’ compensation insurance has its own unique challenges for employers, which is why it makes sense to ensure policyholders are getting the best possible service and value,” said Cody Allen, Territory Manager at SFM. “By working with an insurer specifically dedicated to work comp, agents have access to the tools they need to streamline their processes. And equally important is the high level of care the injured worker receives.”

These factors contribute significantly to SFM’s 96% retention rate.

So, while property renewals may be a headache for many agencies today, don’t sleep on the importance of partnering with a strong work comp insurer.