The first half of 2023 is in the books, and it’s already been a remarkable year for SFM in a number of ways. New and renewal premium results have been outstanding, customer retention continues to be very strong and claim activity is trending in the right direction as the year unfolds.

Premium performance: positive activity on all fronts

SFM has already seen excellent new business results in 2023, continuing the trend in recent years of exceeding expectations. New account development has topped $24 million, well ahead of plan and on pace to top last year’s remarkable growth. SFM is writing these new accounts across a widening territory that now includes eight core states (Minnesota, Wisconsin, Iowa, Nebraska, South Dakota, Kansas, Indiana and Tennessee).

Renewal premium also continues to be very strong, running significantly ahead of expectations through the first half of the year. Year-to-date renewals are more than $2 million ahead of projections. With these returning policyholders, SFM continues to demonstrate industry-leading customer loyalty – with policyholder retention remaining above 96%.

Premium audits, endorsements and retentions also continue to exceed expectations, resulting in significant additional premium generation throughout the policy year. Combined with the increases in new and renewal premium, this has allowed the company to set a new high-water mark for total written premium.

Coming off an already outstanding first half, SFM saw premium numbers leap upward again. In July, the company set a new record for premium in a single month, topping $40 million for the first time. Totals through the month of July showed written premium at nearly $169 million, which is $10 million above plan.

“As we navigate through the remainder of the year, we know that positive results like these come as a result of the excellent relationships we have with our agency partners,” said SFM Senior Vice President Steve Sandilla. “I’d like to personally thank our valued partners for continuing to renew their clients with SFM and providing us the opportunity to write new business with them.”

While premium is up, pricing is down

Premium growth like this is even more remarkable in light of the fact that overall pricing across the workers’ comp line continues to decline. Rate reductions across the states in which SFM operates continue to drive pricing downward.

“Pricing is down roughly 5% on our book as a whole but might vary depending on what state you are in,” Sandilla said. “Year-to-year we are sitting at a price reduction of 4.9%, and while this is 1.7% better than expected, pricing continues to be a challenge as we write accounts.”

Claim activity, from stormy to calm

With an increase in premium comes an increased exposure base for injuries and claims. With that expanded book of business, one might expect to see claim activity rise at a similar rate. To the contrary, SFM has seen claim frequency and severity well moderated throughout the year. Year-to-date claims have been close to SFM’s overall projections, with both frequency and severity trending strongly downward though the calendar year.

“We started off a little rough with a higher-than-expected number of snow and ice claims during the long and snowy winter,” Sandilla said. “Once the winter weather finally let go, those claim numbers began shaping up pretty quickly.”

Since April, claim frequency has reverted to a more predictable pace, which has helped overall results through the first half of the year. SFM’s combined ratio is tracking around 95%, which is on pace with the projections that were established going into 2023.

Agents play a critical role in preventing injuries

According to Sandilla, SFM relies on agent partners to encourage policyholders to keep their workplaces safe, especially during the winter slip and fall season. By spreading the word about winter workplace safety, agents can help prevent costly and potentially tragic injuries.

“We need our agents to remind their policyholders to take advantage of SFM’s safety resources to keep their employees safe,” Sandilla said. “Make yourself familiar with the valuable materials on our website and you can make a big difference in reducing injuries for your policyholders.”

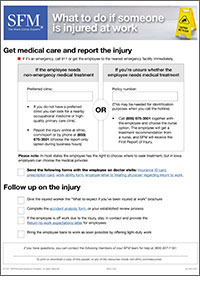

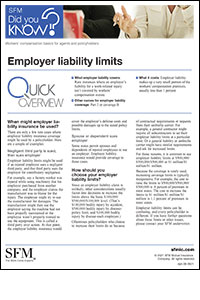

SFM’s website offers hundreds of educational resources focused on making workplaces safer. These materials are available free of charge for agents and policyholders at sfmic.com. Popular resource topics include safety for new hires, back injury prevention and avoiding outdoor slips and falls. At this time of year, the latter category is particularly important with potentially dangerous winter weather approaching.

“Whether it’s the resources on our website or the conversations our underwriters have with agents every day, we do everything within our grasp to earn our customers’ loyalty,” Sandilla said. “When an agent brings a client to SFM, we understand that they’re trusting us to attend to that customer’s every need, and we’re grateful for every opportunity that gives us to succeed together.”

View more Agent Agenda articles

Peter Lindquist has been part of the legal team at SFM since 2018.

Peter Lindquist has been part of the legal team at SFM since 2018.