This article was adapted from our Loss Prevention 101 webinar. The full recording is available on our webinar page.

Preventing work injuries can save you money, time and stress, but those aren’t the most important reasons to establish a strong workplace safety program.

“Always remember that at the center of every workers’ compensation claim is a person and an injury can interrupt their life, their family, their hobbies, and more,” said SFM Loss Prevention Specialist Mike Fetting. “It’s important not to lose sight of that fact.”

In addition to the impact to the employee, work injuries can lower morale among coworkers and increase workers’ compensation premiums.

The only controllable item in an organization’s workers’ compensation premium cost is its experience modifier (e-mod) which is directly impacted by claim costs and severity. When a claim happens, it affects the company’s e-mod for 3 years.

If your claim history is about average among similar businesses, your e-mod will be 1.0. Each claim that results in a cost has the potential to increase your e-mod above 1.0, meaning worse than your peers, which directly increases the premium amount you pay. The lower your e-mod is, the less you pay in premium.

Hazard assessments and developing controls

Every safety program should include an ongoing process to identify workplace hazards, including anything within the scope of a job duty that could cause physical or mental harm to employees. For example, loud noise levels, wet floors or cracks in the parking lot could all be workplace hazards.

Depending on where employees are working, hazards could exist inside, outside, on a jobsite or even over the road, said SFM Loss Prevention Specialist Dana Mickelson.

Hazards can arise from materials, equipment, tools, or machines used by employees or within the workplace. They can even arise from people such as outside contractors, employees who create unsafe conditions for others, or supervisors who do not correct unsafe issues.

There are several assessment methods that safety and loss prevention leaders can use to identify hazards:

- Identify loss history trends. For example, if an organization had 10 injuries last quarter and five are slips and falls from a wet floor, that should be a good indication to focus on slips and falls. Even if there aren’t any trends, employers can still use loss history to determine which jobs or areas to focus on.

- Use other records to find risks and hazards to focus on. Examples include inspection reports, data safety sheets and job hazard analysis.

- Complete inspections. Inspections can be done by a member of your safety committee, an employee, a supervisor or other leader, or a third party. They should also be completed after incidents occur as part of the investigation process. We recommend performing inspections periodically at different intervals, such as daily, monthly, or annually, depending on the hazard.

- Conduct investigations. Injuries and near misses should always be investigated. The steps of an investigation include collecting facts – who, what, when, where and how – and then analyzing the facts to determine the root causes. Once the root causes are identified, decide what corrective actions to take for each root cause.

- Have discussions. Ask employees about their safety concerns because they know and understand their job the best. Consider developing a safety committee consisting of different disciplines and departments to discuss hazards. During the discussions, think about potential emergency situations, and routine and non-routine tasks, such as those completed only once a year.

Prioritize the hazards identified

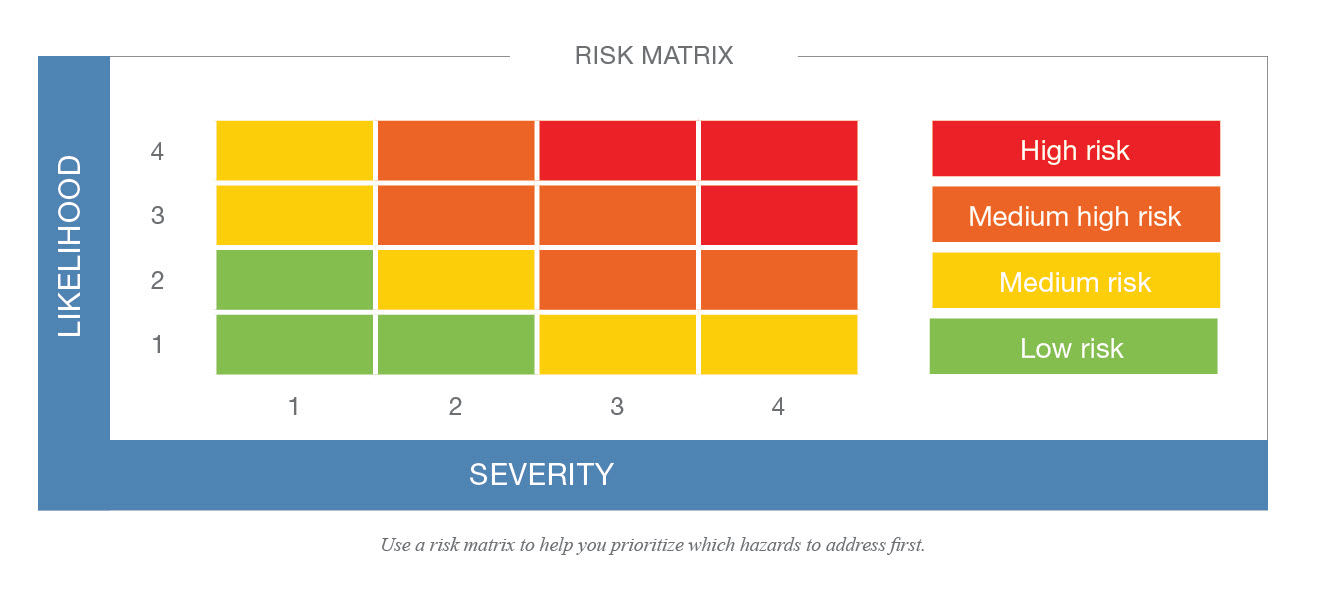

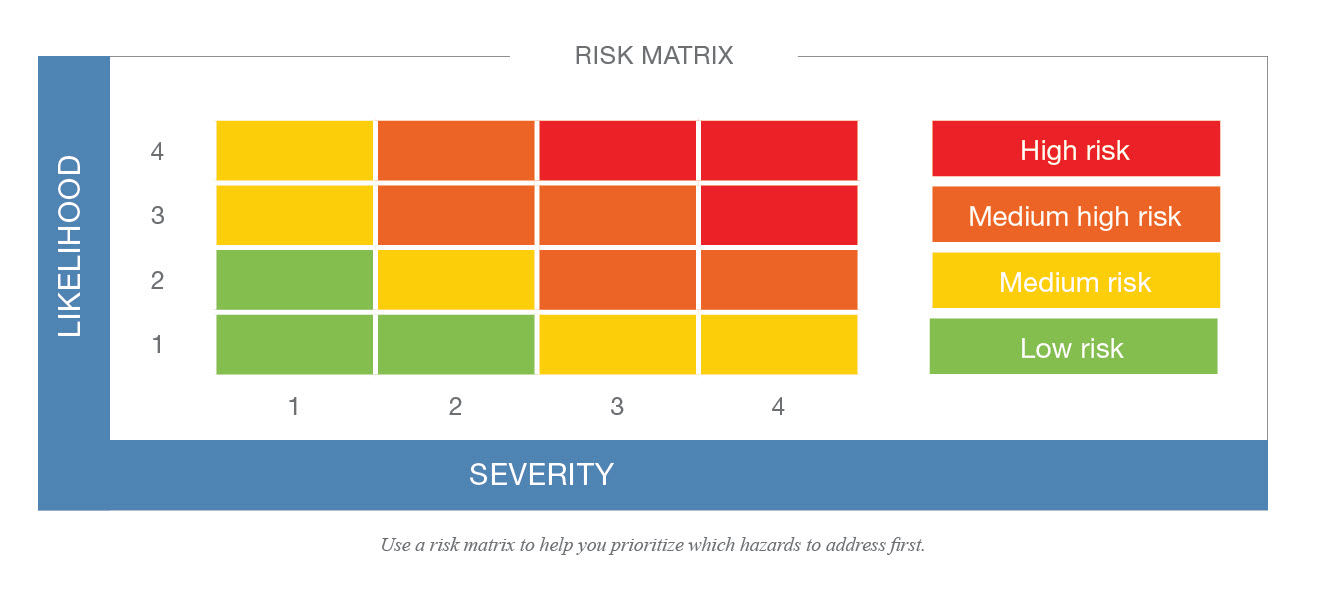

Some hazards will have easy fixes or can be corrected on-the-spot, but if there are several hazards without quick fixes, use a risk matrix to help you prioritize. A risk matrix is a grid where you plot likelihood of occurrence on one axis, and severity on the other.

First, determine the likelihood that an incident or event will occur based on a numeric scale – for example, one represents the lowest likelihood and four is the highest. Then, determine the severity if an incident or event were to occur, with one being low severity and four being catastrophic. For example, if you determine a hazard has a likelihood of three, and a severity of two, that is a medium-high risk hazard and should be given higher priority than the low-risk and medium-risk hazards.

Hierarchy of controls

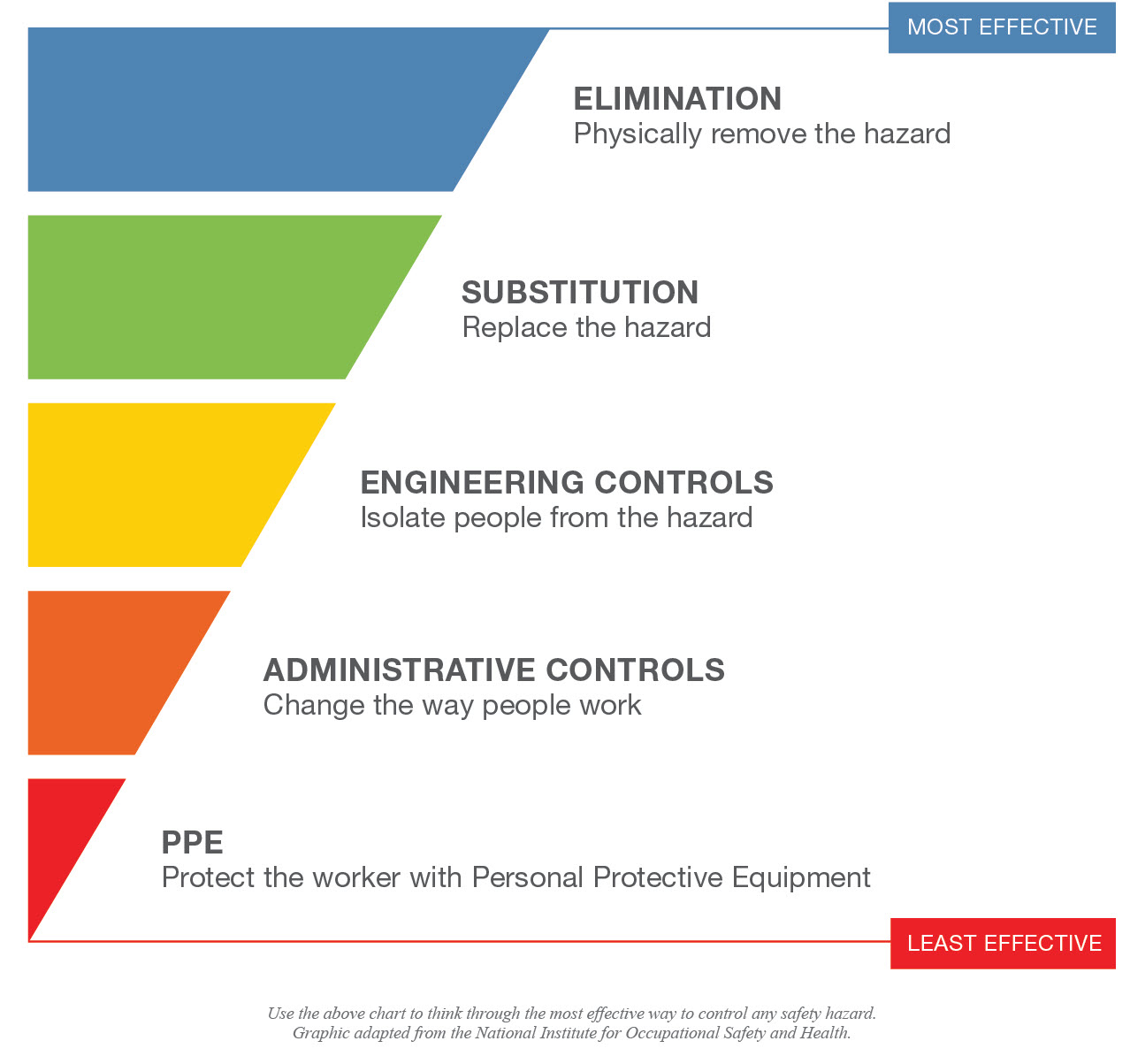

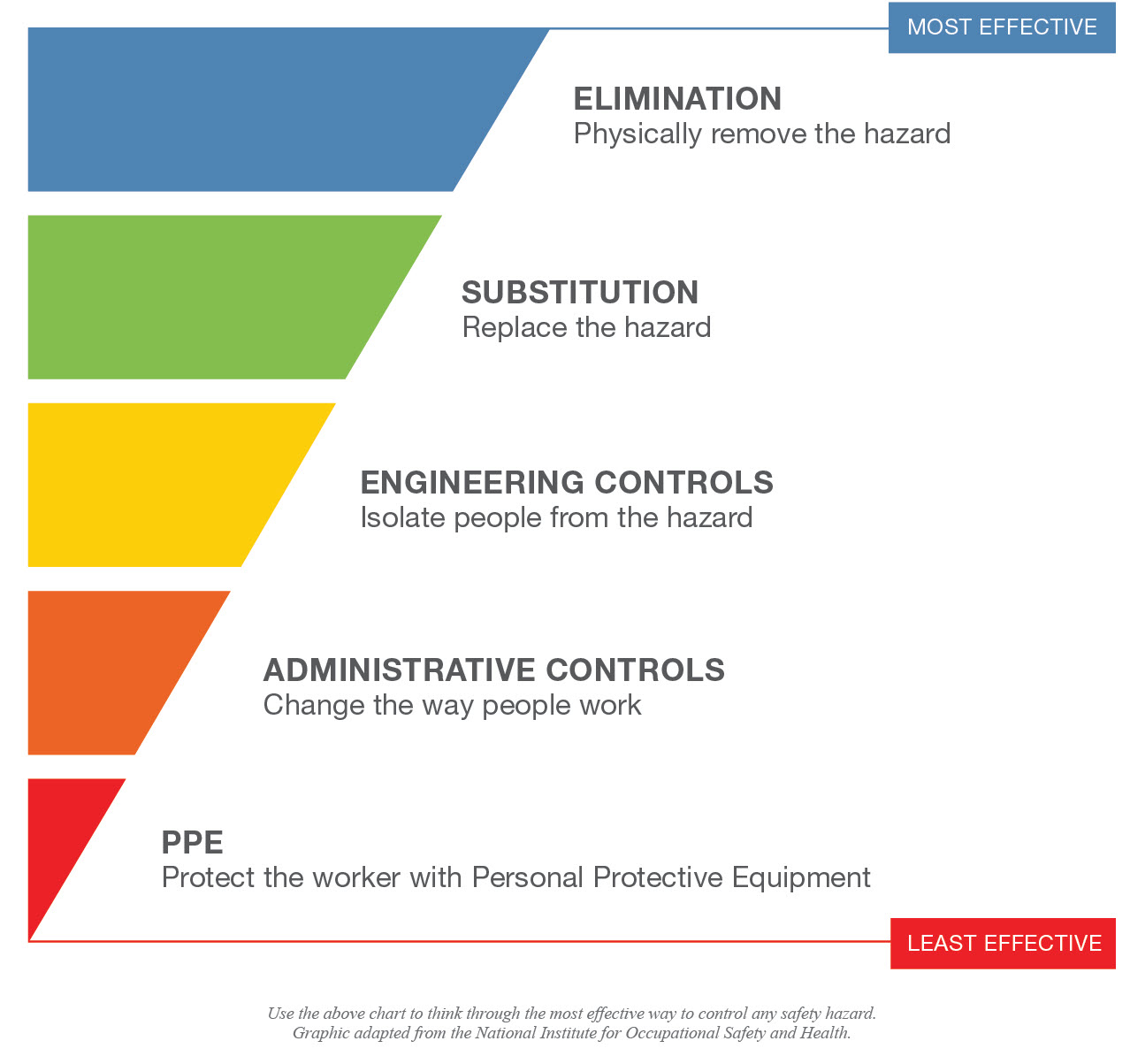

After prioritizing hazards, determine what controls (i.e., corrections) to put in place. There are several options, and some are more effective than others. These options, ranked from most effective to least effective are:

- Elimination: Physically remove the hazard

- Substitution: Replace the hazard

- Engineering controls: Isolate people from the hazard

- Administrative controls: Change the way people work

- PPE: Protect the worker with personal protective equipment

There will most likely be several controls for each hazard. Some controls will be an immediate fix, and in most cases, you need to determine controls that will result in improved and sustainable corrections.

Finally, implement the controls. Develop a plan to document progress and set accountability. The plan should include the hazard, controls, target due dates, who is responsible for implementation, and a completion date.

Keep in mind that performing assessments and determining and implementing controls is a continual, repeated process.

To learn more about building and maintaining your safety and loss prevention program visit the safety tab on our website. You can also reach out to your SFM contacts.