Career areas at SFM

It’s our mission at SFM to inspire safer workplaces by protecting workers from harm and helping the injured recover. Our employees live this mission every day no matter what their role is within the organization. Helping others and making a difference in people’s lives is what motivates our employees, makes us who we are as a company, and gives our jobs meaning. Check out the many rewarding career paths available at SFM.

- Actuarial

- Administrative

- Analytics

- Claims management

- Communications

- Compliance

- Customer service

- Direct sales

- Finance / accounting

- Human resources

- Information technology

- Internships

- Legal

- Medical bill review

- Nurse case management

- Occupational rehab

- Premium audit

- Project management

- Safety consulting (loss prevention)

- Special investigations

- Subrogation

- Underwriting / marketing

- User experience

Highlighted career: Claims management

Make a difference in people’s lives and use your critical thinking and people skills to facilitate successful outcomes for workers’ compensation claims. SFM claims professionals work with injured employees to ensure they receive appropriate medical care and help them return to work when they are medically able. They work collaboratively within multifunctional teams to manage and investigate claims to determine compensability, advocate for the employees and employers involved, and work with medical providers to verify benefits are paid according to state guidelines and company best practices.

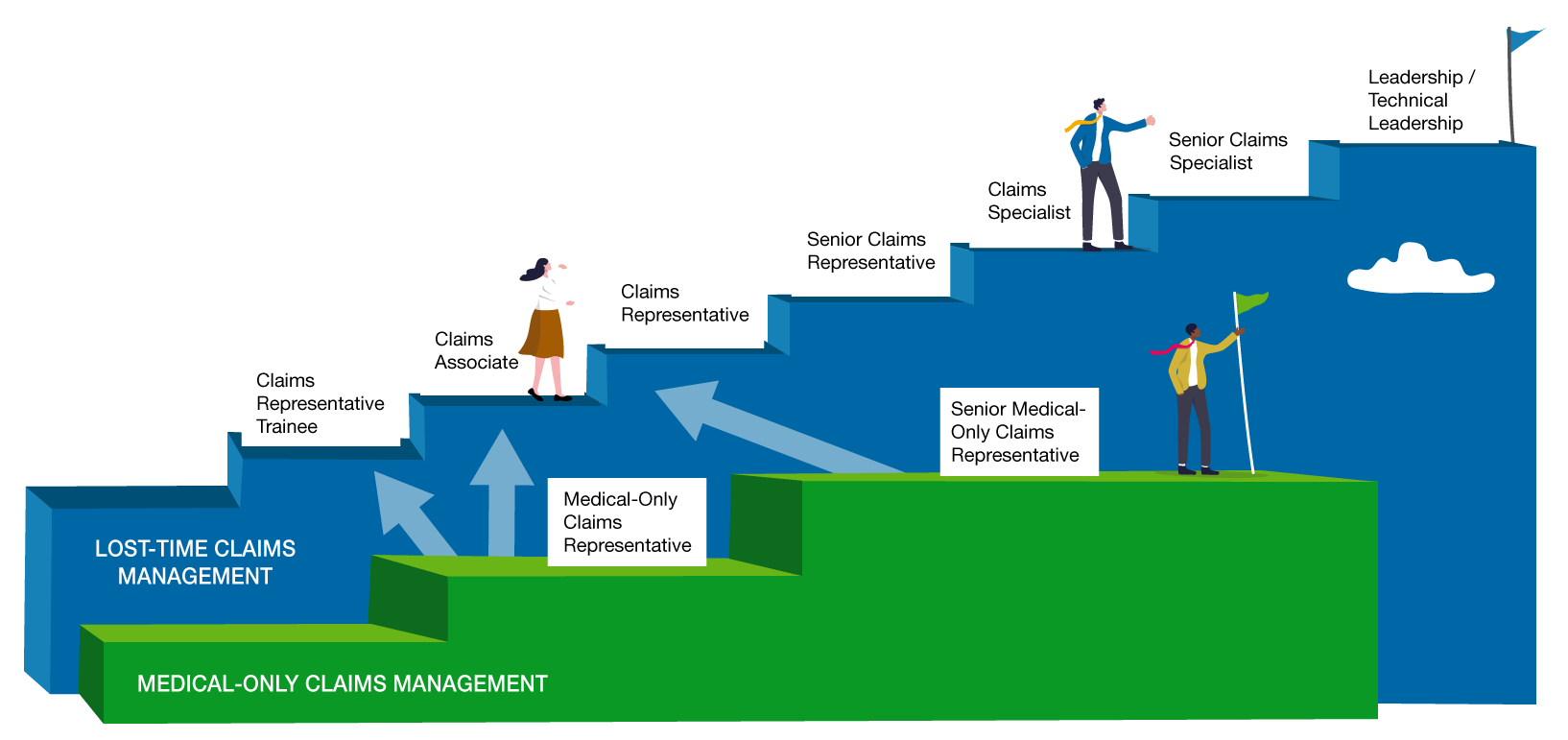

There are two claim career tracks. Medical-only claims professionals handle workers’ compensation claims for injured employees who need medical treatment but don’t miss any time from work. Lost-time claims professionals manage claims for injured employees who also receive wage-loss benefits when they aren’t able to work due to their injury.

Medical-only claims management track

- Medical-Only Claims Representative

- Senior Medical-Only Claims Representative

Medical-only positions also often transition to lost-time claims positions at various points within that track.

Lost-time claims management track

- Claims Representative Trainee

- Claims Representative Associate

- Claims Representative Specialist

- Senior Claims Specialist

- Leadership or Claims Technical Specialist

Highlighted career: Underwriting

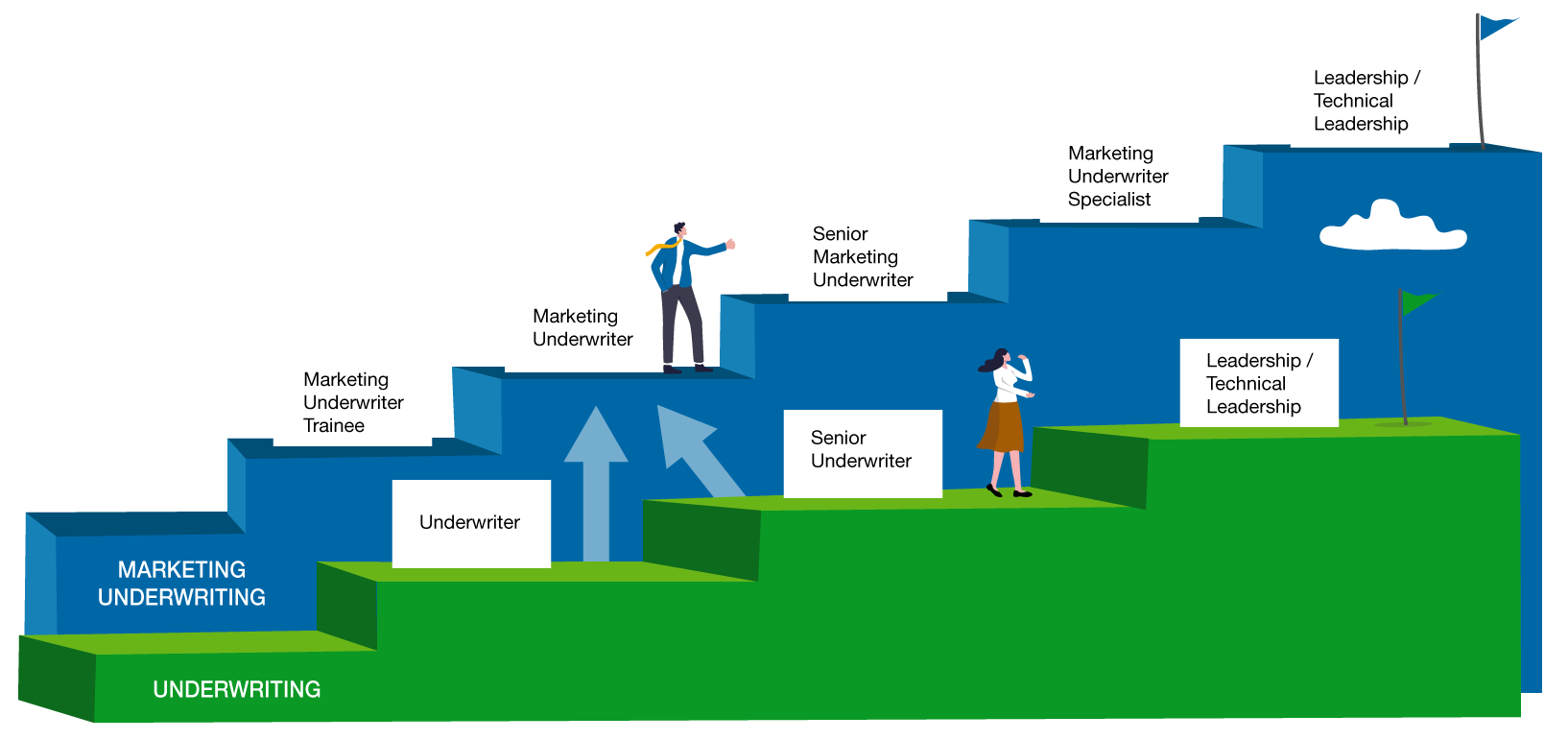

Have a career where you make a difference by helping foster safe workplaces. It’s important at SFM that we insure the safest, most responsible employers who work hard to keep their employees safe. Underwriters play a role in creating safe work environments by determining what businesses and organizations we will insure for workers’ compensation coverage. They work as part of multi-functional teams and use their analytical and customer service skills to determine potential risks, decide whether to write new business or renew current accounts, and develop relationships with agents/brokers to build and sustain SFM’s book of business.

The underwriting and marketing underwriting paths are similar in nature, but Marketing Underwriters focus more on meeting with agents/brokers to build and sustain business, where Underwriters do less traveling and marketing in their roles.

Underwriter track:

- Senior Underwriter

- Underwriting Technical Specialist

Underwriters often transition to marketing underwriter positions at various points within that track.

Marketing underwriter path:

- Marketing Underwriter

- Senior Marketing Underwriter

- Marketing Underwriting Specialist

- Large Account Executive

- Underwriting Technical Specialist