On May 16, 2022, the Minnesota Supreme Court upheld an award of workers’ compensation benefits to an employee for his hearing loss due to long-term exposure to noise over a 30-year period working for five employers.

In Sershen v. Metropolitan Council, the Minnesota Supreme Court found that Dennis Sershen had suffered occupational hearing loss during his time working in manufacturing. He worked in various roles in manufacturing starting in 1986, in which he claimed he was regularly exposed to hazardous noise levels on the job. He reported his hearing loss began around 1994, requiring him to wear hearing aids.

Following his retirement in 2017, Sershen filed a workers’ compensation claim for medical benefits for hearing loss and permanent partial disability against his five past manufacturing employers – Streater Inc., Truth Hardware Corp, SPX Corp, ATEK Cos. and his most recent employer, the Metropolitan Council.

Sershen then settled his claims against SPX and ATEK on a Pierringer basis prior to the hearing, with the two companies paying lump sums to the employee to be released from the litigation and making it so that neither the employee nor the other employers and their insurers could later collect from them.

At the hearing, the compensation judge ordered Sershen’s last employer, the Metropolitan Council, to pay his medical benefits, citing Minnesota Statute 176.135, subd. 5, which assigns liability to the employer and insurer on the date of the last exposure to the hazard. The judge found that Sershen’s last exposure to a noisy environment was at the Metropolitan Council and his last significant exposure was at SPX. The judge did not make any findings on whether the employee had sustained a disablement and was owed permanent partial disability, instead declaring the issue moot.

The Metropolitan Council appealed the judge’s decision and the Workers’ Compensation Court of Appeals (WCCA) affirmed. The WCCA also clarified that the permanent partial disability issue was moot because of the Pierringer settlement between Sershen and two previous employers, one of which was SPX, which was found to be Sershen’s last significant exposure and a contributing factor to his hearing loss.

The Metropolitan Council appealed again, and the Minnesota Supreme Court once again affirmed that under Minnesota Statute 176.135, subd. 5, the Metropolitan Council was liable for paying the medical expenses as it was the last exposure, regardless of whether that exposure was significant. The Minnesota Supreme Court then remanded the case to the hearing court to determine whether Sershen sustained a disablement and is therefore owed permanent partial disability benefits.

The Minnesota Supreme Court explained that if disablement is found, then under Minnesota Statute 176.66 the Metropolitan Council will be able to seek reimbursement for medical benefits paid to Sershen from the employer deemed the last significant exposure to the employee’s hearing loss, SPX. However, since SPX settled on a Pierringer basis, the employee would then have to reimburse the Metropolitan Council if disablement is found.

The Minnesota Supreme Court reasoned this approach matches the legislative intent which allows the employee to timely collect benefits while the employers and insurers parse out liability for the last significant exposure.

You can read the full court decision here .

View more Agent Agenda articles

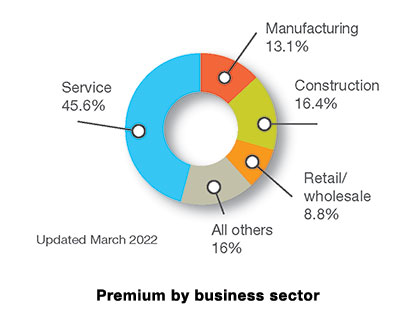

By all objective measures, SFM’s financial results for 2021 are outstanding. From reaching new heights in customer retention to setting records in new business and total written premium, the company has excelled in virtually every category of performance.

By all objective measures, SFM’s financial results for 2021 are outstanding. From reaching new heights in customer retention to setting records in new business and total written premium, the company has excelled in virtually every category of performance.