August 23, 2017

Q & A with researcher Katie Schofield, Ph.D.

One visit from a loss prevention representative — that’s all it took to measure a significant reduction of risk for a lost-time claim in a newly published study.

The research, published in the September 2017 Journal of Safety Research , shows the value of loss prevention representatives for helping a high-risk industry reduce severe employee injuries.

In the study, small and medium-sized construction firms tracked their lost-time claim frequency and the number and type of loss prevention contacts they’d had. Researchers then quantified the connection between contact and reduced lost-time injuries.

We spoke to the study’s lead author, Katie Schofield, Ph.D., assistant professor at the University of Minnesota-Duluth. Schofield is a former SFM loss prevention representative.

The interview has been edited for clarity and length.

What led you to this research?

I used it for my doctoral dissertation, looking at injury burden and construction contractors, particularly smaller ones. They don’t have a full-time safety person. Oftentimes they weren’t getting safety or health [resources] from anyone else, except loss prevention reps. Because I worked with them myself as a loss prevention rep, I was interested: Is what we’re doing making a difference? Is it doing something positive?

Compared to groups that had no loss prevention contacts, when employers did have contact with a loss prevention rep, their risk of a lost-time claim was reduced.

~ Katie Schofield

That’s part of my story behind this, too. Insurers are such a valuable resource, because loss prevention reps can get out there and really have the opportunity to help the business, disseminate research, make the business case for safety.

What were the conclusions you were able to draw from looking at the data over a number of years? Did anything surprise you about these results?

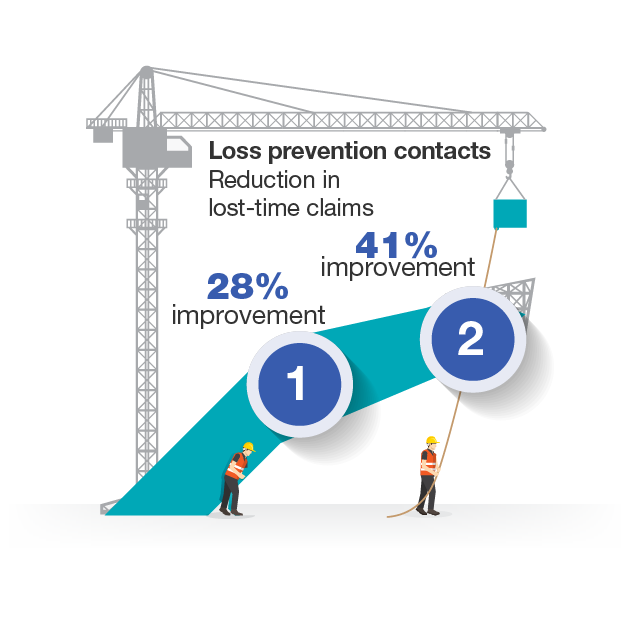

It was heartening to see that there was a significant reduction in risk with these on-site visits with policyholders. Compared to groups that had no loss prevention contacts, when employers did have contact with a loss prevention rep, their risk of a lost-time claim was reduced. Employers that had one contact had about a 27 percent reduction in risk. Employers that had two contacts had a 41 percent reduction in risk. And then three or more contacts was a 28 percent reduction in risk.

So the risk reduction doesn’t continue to go up evenly with repeated visits. Do you have an explanation for the fluctuation, how risk was reduced more with two contacts than with three or more?

Somewhere between that second and third visit, you’re still getting a reduction – not as dramatic of results, but still a significant reduction. That was just interesting in trying to consider, OK, why is this happening? How do we look at what we see in these results here and try to find an explanation in real life?

When you’re first establishing this contact and giving policyholders resources or a plan of action, that would be that first contact that would reduce the risk.

Then maybe your second contact, you check back in, you see how things are going, you follow up. Those might be the things that have the biggest impact, and then with each subsequent contact, you’re still making a difference, but it’s not that dramatic as the first ones. So the effect tapers down.

Or, those accounts that are being visited a lot, they may have a higher risk to begin with. Perhaps that’s why the trend doesn’t continue with bigger and bigger reductions of risk. But it still is significant; 28 percent risk reduction at three or more contacts, that still is a nice effect that you’re seeing there.