May 10, 2024

Why early return-to-work benefits your employees and bottom line

Did you know that the longer an employee is off work due to an on-the-job injury, the less likely it becomes that the employee will ever return to work?

That’s why employers and injured workers benefit from strong return-to-work programs.

Even if injured employees can’t return to their regular jobs right away, bringing them back as soon as possible by providing modified-duty tasks or reduced hours helps them:

- Recover faster

- Stay in the routine of working

- Feel productive

- Maintain workplace relationships

Employers also benefit by bringing injured employees back to work as soon as they’re medically able. Having employees back at work, even part-time or in a different role, can:

- Reduce the likelihood of litigation

- Help control workers’ compensation claim costs, which affect future premiums

Past workers’ compensation claims affect future premiums

You probably know that your loss history is taken into account when calculating your workers’ compensation premium, but you may not know exactly how it works.

Your state’s workers’ compensation data collection organization calculates an experience modification factor (e-mod) for each employer that meets state-specific qualification requirements.

If your loss history is average for your class and size of business, your e-mod will be 1.00. If it’s better than average, it will be less than one. Because your e-mod is used as a multiplier when calculating your premium, a better-than-average e-mod will generally lower your premium.

For more details on this process, see our CompTalk on e-mods and read our blog, How your workers’ compensation e-mod is calculated.

Preventing lost-time claims pays off

When calculating an e-mod, not all claim costs are treated equally.

If a claim remains medical-only, meaning the injured worker does not receive wage-replacement (also called lost-time) benefits, claim costs are discounted by 70 percent.

To keep a claim medical-only, you must bring the employee back to work before your state’s waiting period ends. For example, waiting periods in these states are:

- Three days in Iowa, Minnesota and Wisconsin

- Seven days in Nebraska, Kansas, South Dakota, Indiana and Tennessee

Split-point increases make return-to-work more important

The split point — used in the e-mod formula for workers’ compensation — is the dollar level at which each claim is divided into two parts:

- Primary (the cost of each claim incurred below the split point)

- Excess (the cost of each claim incurred above the split point)

When total costs for an individual claim rise above a split point that’s set by each state annually, those costs are also discounted for the purposes of calculating your e-mod.

The split point ranges from $17,500 to $29,500 in the states of Minnesota, Wisconsin, Iowa, Nebraska, Kansas and South Dakota.

Example: How return-to-work impacts future premium

If you can bring an employee back to work before the waiting period ends, the impact of the claim on your e-mod and future workers’ compensation premiums will be significantly less.

Here’s an example:

Consider two assisted living facilities, each with about a dozen employees and currently paying about $23,000 in workers’ compensation premium.

A certified nursing assistant at the first facility slips and falls while working. Her medical bills total $7,500, but she is able to start doing light-duty work filing and answering phones before the state’s waiting period ends, so the claim remains medical-only.

At the second facility, another nursing assistant has a similar accident, but her employer does not provide light-duty work, and she ends up receiving some workers’ compensation benefits for lost pay. The combined cost for her medical expenses and lost-time compensation total $7,500.

Although the total cost for both claims is the same, the impact on their respective workers’ compensation costs are very different — only 30 percent of the medical-only claim impacts the employer’s e-mod, compared with 100 percent of the lost-time claim.

What does this mean for these employers’ work comp premiums? The claim that remained medical-only would cost the employer $2,850 over three years in terms of increased premium. In comparison, the lost-time claim would cost the employer $9,494 over three years.

How to start a return-to-work program

If you don’t have a return-to-work program already, follow these four steps to start one:

- Draft your policy

Formally state that your company intends to bring injured employees back to work as soon as they’re medically able, and will provide adaptations or light-duty work when needed. For guidance, see SFM’s sample return-to-work program.

- Appoint a claims coordinator

This is an individual tasked with overseeing workers’ compensation claims and return to work. Have this person develop a plan for reporting injuries and communicate it to supervisors and employees.

Having step-by-step instruction sheets around also helps the process. For more details, see SFM’s CompTalk on claims coordinator duties.

- Select a primary care clinic

Establish a good working relationship with a local clinic where the physicians understand occupational medicine and return-to-work.

If possible, meet with doctors at your preferred clinic to give them an overview of your organization and tell them you are committed to returning employees to work as soon as they are medically able. Suggest that your employees go there if they’re injured.

Note that in most states, employees have the right to choose where to have their injuries treated.

- Identify transitional jobs

Transitional or modified-duty jobs provide opportunities for your employees to return to work even when medical restrictions prevent them from doing their regular jobs.

That might mean having an injured employee work in a different department temporarily.

To come up with ideas ask your managers, “What would you do if you had an extra pair of hands?” For more ideas, check out our lists of transitional jobs broken down by industry.

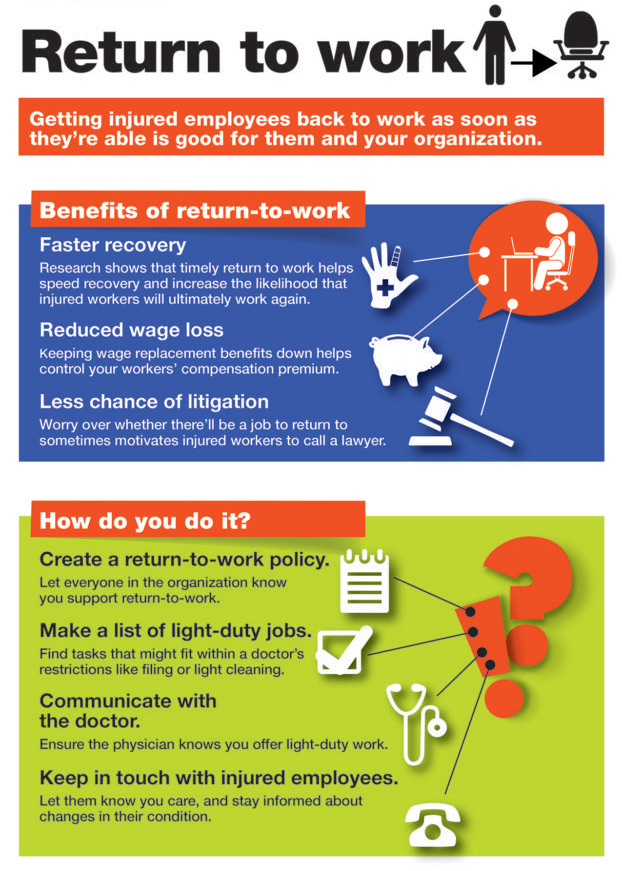

See our infographic on return-to-work below:

This is not intended to serve as legal advice for individual fact-specific legal cases or as a legal basis for your employment practices. Originally posted in February 2021; updated in May 2024.